DOWNLOAD YOUR FREE “THE 5 MOST IMPORTANT PROBATE MUST-KNOWS” EBOOK

"*" indicates required fields

We Make it Simple

PROBATE AND ESTATE ADMINISTRATION

There are so many different challenges that result from the death of a loved one. Probate clients and their families are dealing with grief while also trying to understand the legal aspects of what must be done after such personal loss. At Bellomo & Associates, LLC, our team works closely with clients and provides tools to guide them through every step of the estate administration process.

Probate is the legal process whereby the Court appoints an executor to for the estate to collect the assets of the decedent, make sure all bills and expenses are paid, including the Pennsylvania inheritance tax, and distributes the remaining assets pursuant to the wishes of the decedent as outlined in their Will. If a person dies without the benefit of a Will the Commonwealth has a set of rules determining who can act as the administrator of the estate and how assets will be distributed.

Our office will walk you through the process from beginning to end including:

- Appointment of the personal representative

- Asset valuation

- Determining the order of payment of creditors

- Complying with the terms of the Will, if there is one

- Notices

- Advertising of the estate

- Filing the PA inheritance tax return and insuring all taxes are paid

- Distributions to the beneficiaries

We understand this is a stressful time and we lift much of the burden of estate administration from your shoulders so you can focus on your family.

Trust administration is a process separate from the administration/probate of an estate. While much of the process is the same the biggest difference is that there is no Court oversight and the records of the trust do not become public record. Trust administration deals only with the assets contained in the trust while the administration of an estate may deal with the assets of the estate as well as assets in the trust. This is due to assets in the trust being subject to inheritance tax and thus needing to be valued for inheritance tax purposes. For the administration of a trust our expert team will walk you through the process and make certain all terms of the trust are fulfilled, marshal the assets of the trust, insure all debts and expenses are paid, file the inheritance tax return, and insure distributions are made to the beneficiaries as set forth in the trust document.

Our

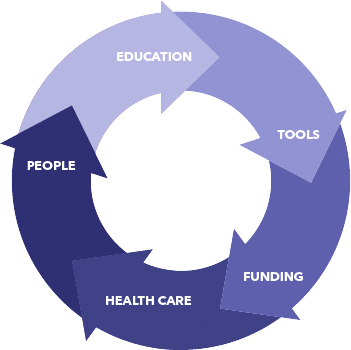

Probate & Estate Process

Workshop & Initial Meeting

Petition Drafting & File With Court

Court Required Actions

Preparation & Filing of Pit and Inventory

Preparation & Filing of Fiduciary Returns

Closed

Red Wagon Club

CONTACT US

FOR PROBATE AND ESTATE ADMINSITRATION PLANNING